#062: OpenGov Acquired for $1.8B, Building SaaS For Law Firms, Average Churn Rates

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

One Biz Story:

OpenGov Acquired for $1.8B

I’m so excited about the OpenGov deal. Zac Bookman, Founder & CEO at OpenGov, has been an investor in my business for a few years. He is incredible, incredibly sharp, has always been there for me, and so I’m so excited to celebrate him and his company today.

OpenGov is not a 2 year success story that somehow sold for a ridiculous amount. Zac and team went on a 12+ year journey, and built their vertical SaaS business brick by brick, the right way.

He GRINDED, probably had many near death experiences, and overcame it all to build something really special.

The only thing I’m mad about is that more people aren’t talking about it!

I did a write-up on OpenGov a few months back. Given the acquisition, I’m reposting it here below:

OpenGov: vSaaS For Local Governments

This guy started a BILLION dollar company while living in a shipping container in Kabul, Afghanistan. This "boring" business creates cloud software for government. This is the incredible story of OpenGov:

OpenGov is a cloud software company whose mission is to power more accountable and effective government. They offer a suite of software for public sector accounting, planning, budgeting, citizen services, and procurement. Their products are purpose-built for the sector.

The company was founded in 2012 by Zac Bookman while he was working in Kabul, Afghanistan under General McMaster's corruption task force. His background is insane. He holds a JD from Yale Law, an MPA from Harvard Kennedy, and studied government corruption in Mexico.

Zac teamed up with Nate Levine, Dakin Sloss, & Joe Lonsdale. The group began studying government budgeting in the aftermath of the Great Recession. They started by asking local governments for budget data and found their systems so archaic they couldn't even provide it...

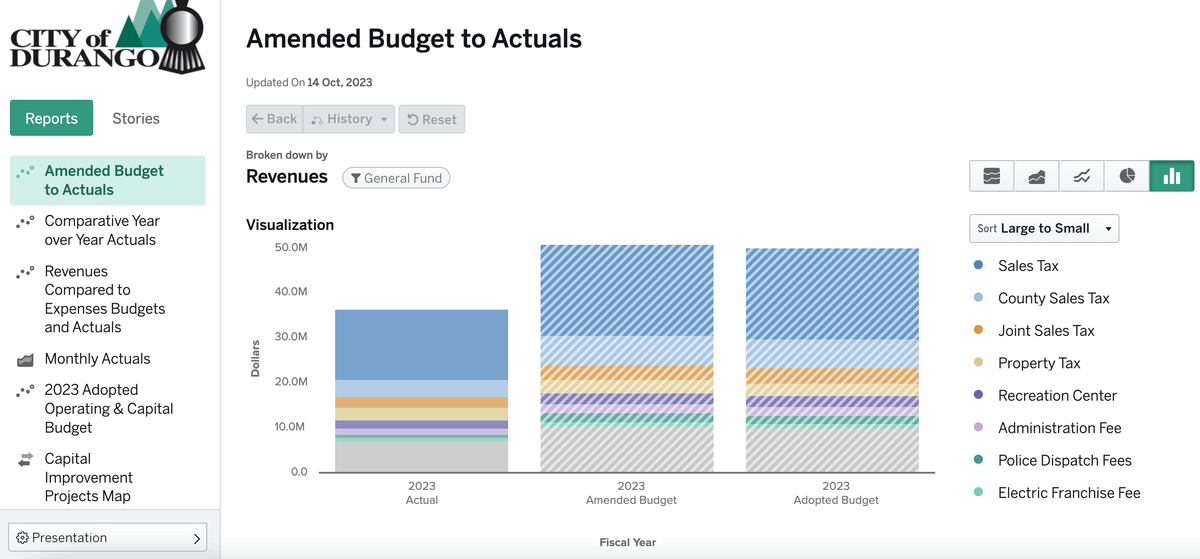

They began by building a reporting & transparency platform that enabled governments to actually access their financial data and share it with the public in an interactive and visual way. The platform also helped governments analyze their own data and compare it with peers.

Their GTM is all about face-to-face sales and relationship building. Big ticket ACV typically translates to this. They eventually acquired their first customer, right in their HQ's backyard, the City of Palo Alto.

Zac says if someone wants to sell software to governments they should be "batshit crazy". That's how hard it is. But they've persevered. After ~10 years they now have 1,500 cities, counties, and state agencies across 49 states. That's really FAST for government.

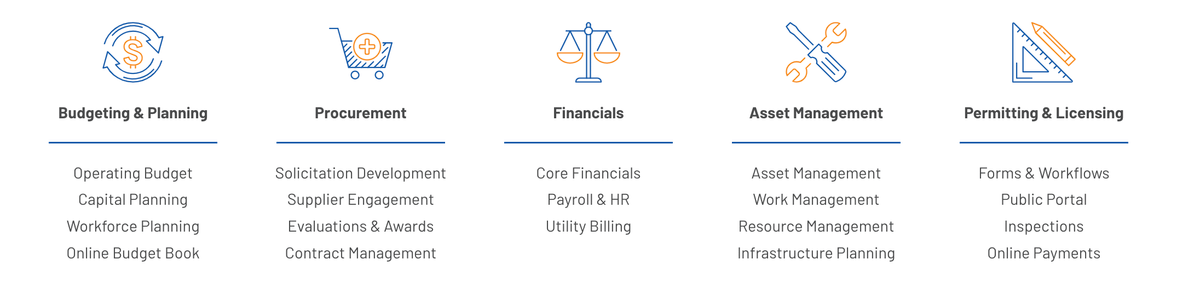

In vSaaS it's ALL about going multi-product. OpenGov followed this path, expanding its suite to include: -Budgeting and Planning -Accounting and Financial Management -Permitting and Licensing -Procurement -Asset Management

They've been on an acquisition spree with a goal of building a one stop shop, end-to-end vertical SaaS platform for the space. Some of the acquisitions include ProcureNow, a cloud procurement platform, and Cartegraph, a provider of asset management software.

OpenGov is also backed by the best of the best. They've raised over $178 million in funding from investors like Cox Enterprises, Insight Partners, Accel, Andreessen Horowitz, and Emerson Collective. Marc Andreessen even serves on the board...

This is an INCREDIBLE company few talk about. Their vision is to power more effective and accountable government and they are well on their way... By taking government to the cloud they cracked a $1.2 BILLION, as of February 2022, according to PitchBook.

ICheers to @ZacBookman, and the @OpenGovInc team. It's been fun to watch.

One vSaaS Breakdown:

Law Firms Industry Scorecard

I get asked all of the time, "Which industry should I build a SaaS for?"

The answer to that question lies in building scorecards that rank each industry based on the type of SaaS business you want to build.

Here is Industry Scorecard #004: Law Firms 🧵

Market Size:

The Legal Services market is BIG, it's trending towards $500B in the US and $1 Trillion globally. There are 1.3M lawyers in the US across ~450K firms. The average hourly rate for lawyers in the US is $313.

Market Segmentation:

In terms of number of firms, it's very evenly distributed across Small, Medium, and Large. BUT, it's estimated that the top 100 firms own about 1/3rd of all revenue in the United States.

SaaS Competition:

The space is very crowded when it comes to software. Clio reports that 150K lawyers in the US use their law firm management software (11% penetration). However, The Mckinsey Global Institute says that 23% of the work done by lawyers could still be automated.

If you wan't to go deeper on competition I dove into Disco, a publicly traded law firm SaaS tool a few months back: https://twitter.com/lukesophinos/status/1729149392714936567

What are law firms currently using these SaaS tools for?

Product Opportunity:

It is no secret that AI is a really strong fit for law firms, specifically in discovery, document management, search, and analysis. I'd start here and see what are all the ways AI could disrupt incumbents. But many are already well on their way here.

GTM:

The segmentation here is a go-to-market leaders dream HOWEVER law firms are notoriously difficult to sell into. A healthy mix of inside and outside sales has worked for most of the big players but it doesn't seem like there is one cooker cutter customer acquisition motion.

Bootstrap or VC-Backed?

Given how competitive and crowded it is for SaaS, carving out a niche and building a profitable business from day one makes more sense. If you discover a scalable opportunity along the way then go for it, but I wouldn't raise VC here out of the gates.

One ‘How To’:

Average Churn Rates in SaaS

According to KBCM Technology Group Private Company '22 SaaS Survey:

Median gross dollar churn for private SaaS companies is 14%

Median logo churn is 13%

Median annual non-renewal rate is 10%

Given a tough economy, this was likely worse in '23

Where does your business land? Here’s an industry comparison to give you a further idea:

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: