#061: vSaaS for Coffee Shops, Embedded Tools, Car Dealership Software Industry Scorecard

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

One Biz Story:

Odeko: vSaaS for Independent Coffee Shops

The former CEO of SquareSpace is "verticalizing" the restaurant industry with his all-in-one SaaS platform for Coffee Shops. Slice did it for Pizza Parlors. Odeko is doing it for Coffee Shops.

Let's dive in:

Odeko is an operations SaaS that helps independent cafes order supplies and manage inventory. They offer overnight deliveries from their own warehouses in 16 markets. Instead of independent shops figuring all of this out on their own, Odeko offers a turn key solution.

The company was founded in 2019 by Dane Atkinson, a serial entrepreneur who has founded, bought, and sold 10+ companies, including SenseNet and SumAll. He also is the former CEO of website giant, SquareSpace. His expertise lies in scaling start-ups that serve Small Business.

When Dane and his early team first started they didn’t have a product, nor did they know what they were going to build. The initial focus on assembling the right team and identifying the best SMB vertical to support. They stumbled upon independent coffee shops...

Independent coffee shops are a large available market and beautifully skewed towards Dane expertise - SMB's. Odeko wants to give the independent stores (~29% of the market) the same type of SaaS tools and supply chain that giants like Starbucks or Dunkin Donuts have.

Dane built relationships with large independent shops like Birch Coffee & sought to understand their challenges.The problem that floated to the top was supply ordering.

They locked down several customers willing to partner to create the first piece of the Odeko software. Things were starting to click and Dane was began to scale the procurement solution across the industry. That was until Covid hit.

Things came to a halt and Dane described this time as a time of "soul searching". Go forward? Shut down? Something else? It was a difficult time.

Dane & Odeko made the decision to merge with Cloosiv, a mobile ordering system for coffee shops. Mobile ordering + supply ordering would really support independent shops survive the pandemic.And thats just what happened...

90% of their pre-COVID customers re-opened their doors and used Odeko’s new platform to run their businesses. They faced the pandemic head on with little room to maneuver, and emerged having grown to support nearly 10x the number of small businesses they had before the pandemic.

Odeko is also running the classic vertical SaaS playbook and jumping into FinTech taking a piece of every order.The combined companies tap into payments and take a piece of the transaction on the customer side and the supply ordering side.

Today, 10,000+ small business customers nationwide use Odeko's platform streamlines operations, saving time and money for small owners.By using their scale to keep costs low, Odeko claims they can save shops up to 21% on products ordered through their platform.

Roaring out of the Covid Pandemic, Odeko raised $53M in Series D funding led by B Capital, with continued support from GGV Capital and Tiger Global Management. The company plans to use the funds to further develop its technology and open new markets across the country.

Toast build vSaaS for restaurants and is sitting at a $10B market cap.

Slice niched down and built a vSaaS for pizza parlors. Their valued north of $1B+

Odeko is now doing it for coffee shops and likely in the high nine figures of value.

What restaurant vertical is next?

One vSaaS Breakdown:

Car Dealership Industry Scorecard

Are you searching for the “right” industry to build a SaaS solution for? Building a scorecard will help get your journey started and it will help filter out A LOT of noise and make sure the space is one that aligns with the type of business your aiming to build. Over the next year, I’ll be doing 100+ high level industry scorecard breakdowns for you all.

Here is Industry Scorecard #003: Car Dealerships 🧵

Market Size:

MASSIVE MARKET.

There are 17,423 new car dealerships that do $906 Billion in revenue per year. There are 23,627 used care dealerships that do $101 Billion in revenue per year.

Market Segmentation:

The segmentation is in the "lower middle" of the pack when looking at roughly ~1K industries. It's not fragmented but it's not consolidated either. Pretty healthy for a software company with a solid mix of SMB's, Mid-Markets, and Enterprise to sell into.

Competition:

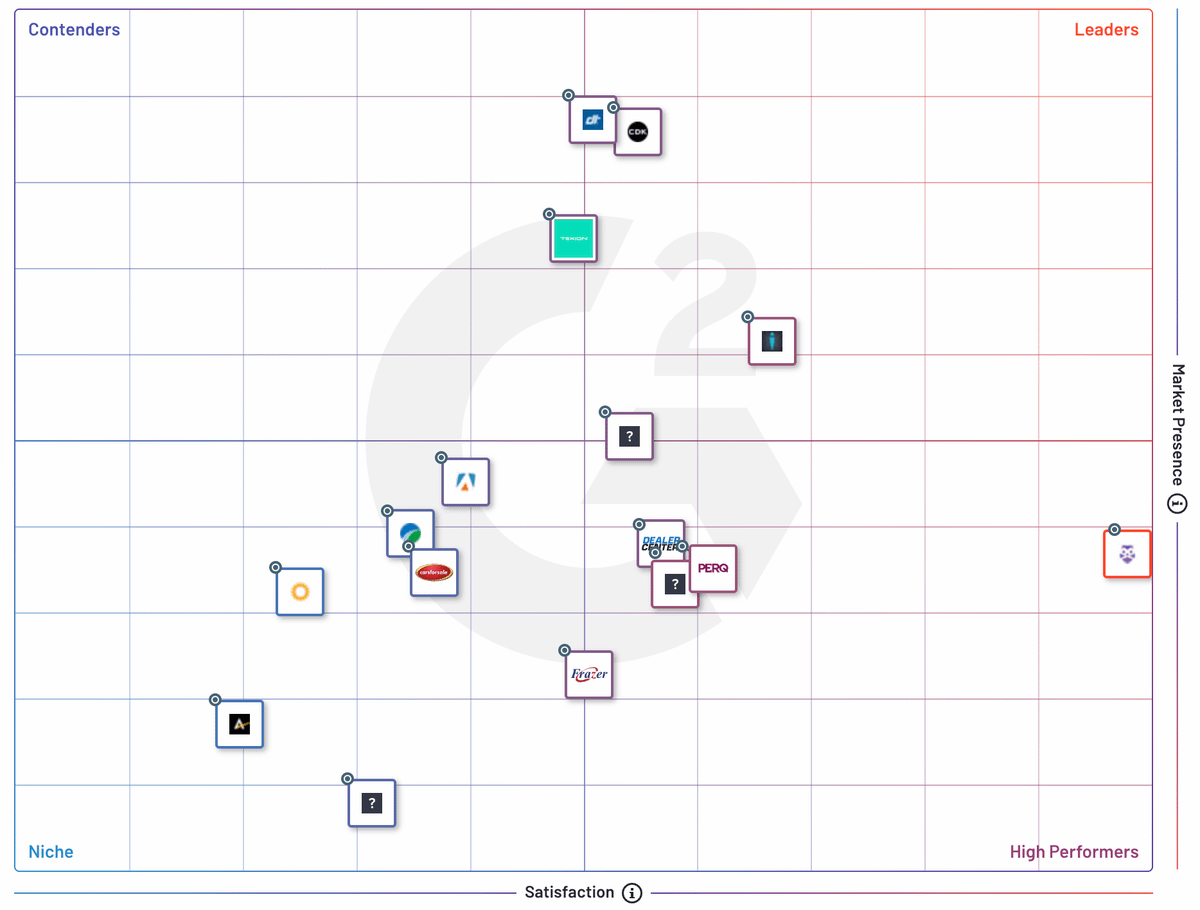

Software vendor competition is fierce here with many dominant players.

DealerTrack

DealerCenter

CDK

Based on G2 data, they are not LOVED, however.

What are dealerships using these SaaS tools for?

Inventory: Know what’s on the lot at any given time.

Loans: Consumer financing or loan processing.

Repairs: Helps organize and schedule auto repairs on site.

MISC: CRM, marketing, accounting, BI, and employee management

Product Opportunity:

They are definetly beyond the "digitization" phase. They have all the workflows covered. The payment / financing part is definetly still painful. I also think a lot of these dealerships SUCK at marketing. I'd probably start there BUT if i’m being honest this space is crowded. It was hard to find something that would be new/novel here.

GTM Difficulty:

Due to the segmentation being pretty healthy, GTM approach will be straight forward and healthy. Successful companies here have deployed inside sales GTM's, content marketing, and outside sales for larger dealers their targeting.

Bootstrap or VC-Backed?

If I was going after this sector I would build a bootstrapped company, and find a small niche around consumer financing that's built into the dealership management software. Looks too crowded for a a massive business here.

That's it for scorecard #3. Let me know if this was helpful or what you'd like to see added for the next one!

One ‘How To’:

Embedded Products You Can Add To Your vSaaS

There are so many tools a vertical SaaS company can "embed" via embedded tools to expand revenue via new product lines.

A few that come to mind:

Payments

Lending

Insurance

Communication Tools

Integration

Assessment

Advertisements

LMS

Analytics

CRM

Compliance

Attendance / Employee Time Tracking

Applicant Tracking System

Banking

Credit Cards

Accounting

Payroll

Inventory Management

What else am I missing? I want to build a massive list of all the embedded tools with all the companies that support vSaaS in these ways. What do you think?

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: