#057: Ceramics Major to $2B SaaS CEO, There's A Better Way To Start A Company, Industry Scorecard No. 1

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week. Written by @LukeSophinos

One Biz Story:

Ceramics Major to $2B Software CEO:

This guy was studying CERAMICS at UCLA when he came up with the idea for what would become a $2 billion software empire. The idea? Software for Storage Units.

This is quite the story…

Meet Storable - a $2 BILLION dollar SaaS empire that is rolling up the entire storage software space. Today, they offer an end-to-end cloud platform that handles everything you could imagine for a storage unit operator:

Marketing, Access Control, Payments, Insurance, & more...

But their story is quite an interesting one. Back in 2008 Chuck Gordon and Mario Feghali we're both studying at UCLA when the two met. Chuck was studying Cermaics and Mario was studying Psychobiology.

So how the heck did they end up with a $2B storage software empire?

Chuck was preparing for a semester abroad and had difficulty finding a place to store his stuff. Chuck poked around storage websites, Yellow Pages, and called storage units around town. That's when the idea happened - an online marketplace to find storage units that had space.

They went all in on the idea and began building their new start-up. Over the next 10 years they took that simple idea and turned it into the largest storage marketplace in the U.S. Their platform has facilitated the storage of 20+ Empire State buildings worth of space since!

Before Chuck and Mario founded their business, 2 brothers who owned their own Storage Units came to the realization that software could help manage their business more efficiently. They built their own software to help manage their units, their employees, and customer payments.

They also realized that every other storage operator could benefit from what they built and formed a new company, SiteLink. Two years later, 500 self storage operators were using their software. Talk about product market fit!

And to add a final and third company to the mix, in 2009 a Kansas City Tech Think Tank, Red Nova, wanted to get into the storage software game as well. They aimed to create turn-key "Shopify-style" websites for Storage Unit Operators. Just like the others, it took off.

In 2018 the 3 companies came together under one brand: STORABLE, to offer a one-stop shop software platform for Storage Companies:

Websites, Marketplace, Management, Access, Insurance, Payment Processing, and Integrations.

Private Equity firm, Cove Hill Partners led the charge.

From 2018 to 2023 the three companies had 22,000 of the ~50,000 storage operators in the U.S. on their platform. Thats 43% market share !!!!

And Cove Hill Private Equity absolutely killed it. In 2020 EQT invested in the business, valuing it at $2 BILLION Dollars.

Storable is a classic example of Private Equity successfully rolling up an industry. My favorite part? Chuck Gordon, the Ceramics major and founder of SpareFoot, is still at the helm as CEO. What's next for them? Given the market share, I assume it's time to go international.

Kudos to all involved in the Storable journey. It's another beautiful example of the power of vertical SaaS. This was a fun one. Thanks Chuck and team for being an inspiration to the rest of us!

One ‘How To’:

Theres A Better Way To Start A Software Company…

The common, and in my opinion, wrong path of starting a business is to

Come up with an IDEA

Line up customer interviews

Ask leading/bias questions that just validate your concept

There is a better way ⬇

Step #1. Find an industry & understand how big it is

There are roughly 1,000 industries defined, tracked, and monitored by the U.S. Census. You can find a list of all one thousand industries and their total operating revenue directly on their website. Additionally, Better Business Bureau has 4,000+ industries on their website!

You need to answer the question, how big of a business do I want to build? If the market isn't big enough to support that it's not the right one for you. VC's need to see massive markets to justify a BILLION dollar plus opportunity.

Step #2. Understand the market segmentation

It's really tough to build software for enterprise companies on day one. Selecting an industry that has healthy segmentation is a safe bet. Telecom, for example, is dominated by a few players. Where as plumbing, is all SMB.

Step #3. Figure out how businesses in the industry operate

You need to understand the full operating flow. It doesn't have to be highly complex but you need to have a good general understanding. Here is a very basic example of how Trade Schools operate:

Step #4. Map out the customer journey

I like to make a customer journey map that illustrates every single step that a customer goes through from start to finish. Mapping this along with how the businesses in the industry operate will open your eyes to problems / opportunities

In Steps 4 and 5 you should find a HOST of problems, inefficiencies, etc. that you could build solutions for. Start building a big list of PROBLEMS and potential solutions a product or service could solve.

Step #5. Look at the software companies that serve the market today.

Map out all of the software solutions in a particular space and which areas of business operations and the customer journey that they serve. From there you can evaluate, is this a highly competitive space?

Step #6. How do you acquire customers in this industry?

Is it outside sales via conferences and events? Can customers be acquired through digital channels ie facebook? Is it inside sales via cold email and calling?

This tells you how difficult it is to acquire a customer.

Step #7. Line up customer Interviews

Line up a bunch of interviews and validate all of the above. The questions you should be asking are tied to everything we've done up until this point. A bunch of your assumptions are likely wrong, now is the time to get them right.

Step #8. Is there product white space?

You now know how businesses in the space operate, the customer journey, the GTM motion, and validated those via a ton of customer interviews. Now you should be able to identify whether or not there is whitespace for a new SaaS product.

Step #9. Build a scorecard

Build a scorecard for 10 industries and see which ones stand out. Your scorecard is going to vary based on the type of business you want to build, ie if you want to build a massive business and raise VC it will look very different from a bootstrap approach.

Step #10. Go Deeper

If you're excited up until this point, go even deeper. Line up interviews with investors, third-party experts and other operators Attend an industry trade show. Re-validate everything you've just learned. DONT be bias, make sure there is a strong fit.

I hope this is helpful and some of you can use it to build the next great industry specific software business. Let me know what else you'd add that I may be missing.

I’m curious to hear your thoughts!

One vSaaS Breakdown:

Industry Scorecard: Residential Treatment Facilities

Market Size:

$26B based on US Census data. 1.1M patients receive treatment at a residential treatment center (RTC) each year.

There are ~20K RTC's in the U.S. They secure $20K+ for a 30 day patient stay, with insurance covering around 50-75%.

Market is growing 7.8% YoY.

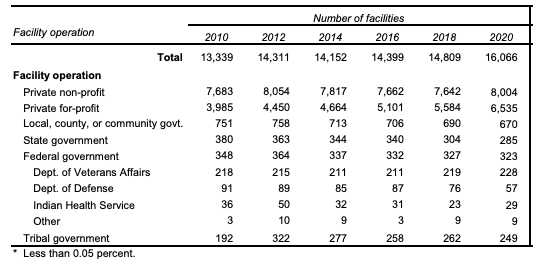

Market Segmentation:

The market is largely skewed towards not-for-profits and for-profits.

It also skews heavily towards SMB, and MidMarket players. With a few Enterprise companies - including American Addiction Centers with a $805M market cap.

Competition:

It seems like most rehab centers use traditional EHR (Electronic Healthcare Records) systems. The EHR space is crazy crowded, as you can likely imagine.

There aren't a lot that "specialize in rehab centers" albeit i'm not sure if they actually need specialization.

Product Opportunity:

There may be an opportunity to specialize an EHR specifically for rehab, and get in with a wedge product around alumni communication and gamification tools.

If you can get into supporting payments it could become a pretty size-able business.

GTM Difficulty:

The segmentation supports the ability to capture SMB, then move to Mid Market, then to Enterprise. So that's positive.

Although it's likely going to be f2f outside sales. I don't see operators of these companies adopting software through digital marketing tools.

Bootstrap or VC-Backed?

If you can get into payments there is a VC backed opportunity here, but you'd have to achieve the lions share of the market, given a lot of the $$ you likely can't process as they go through insurance.

A bootstrapped business is definetly a safer bet.

That's it for Scorecard #1.

This market is near and dear to me, as it is likely for many of you, we all see friends, family, etc. suffer from addiction SO if someone is building great software tools to help let me know!

Thanks for reading and I hope you enjoyed.

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: