#056: Are You Leaving Money On The Table? How To Structure 2024 Bonuses, The Story Of Weave: Software For Dental Practices

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week. Written by @LukeSophinos

One vSaaS Breakdown:

This is crazy…

Did you know expansion accounts for ONE THIRD of revenue post $1M ARR. If you’re not hyper-focused on expansion, and breaking up your platform with modules you’re likely leaving a lot of $$$ on the table…

One ‘How To’:

How To Structure Bonuses That Work For Employees AND The Business

I'm a big believer in Charlie Munger's quote, "Show me the incentive and I'll show you the behavior".

There are two primary metrics that drive the ultimate value of a software or technology company:

Annual Recurring Revenue (ARR)

Net Dollar Retention (NDR)

I view these as the metric North Star.

Additionally, most companies leverage Objectives & Key Results / milestones for each team member to track their individual progress and performance. I often see bonuses be willy nilly or solely tied to an individuals attainment of their own milestones. I think that's wrong.

It has to be about "we" versus "I". Structuring a bonus plan were everyone gets paid on the company AND the individual goals creates the right alignment and incentives for all involved. BUT, it has to be simple! Here's an example...

If an employed makes $100K in base and has the opportunity to earn an incremental $30K via bonus I would structure their incentive plan like this:

33% Individual Milestone Attainment

33% Company ARR Plan Attainment

33% Net Dollar Retention Plan Attainment

If the employee achieves their individual milestones over the 12 month period they pocket $10K incremental. If the company achieves the ARR goal they pocket another $10K. And another $10K for the Net Dollar Retention Plan.

I also do "uncapped" because I don't want people to stop if we're doing a great job. So if they company achieves 120% of the ARR plan they get $12K versus $10K. Same goes for their individual milestones and the Net Dollar Retention goal.

I also pay out bonuses 2X a year, some do it 4X, some just once. I've personally found 2X is the right cadence for us. Mid year and end of year.

Your software company is going to be valued primarily by ARR and Net Dollar Retention. Everyone achieving their individual goals should lead to these two areas being strong. Regardless if they work in accounting, product, or engineering.

If you're NOT tying an employees bonus to the ultimate value drivers of the business do your employees have the right mindset? Are they working on the right things?

This has worked for me but I'm curious to hear how you all are structuring bonuses. What works for you?

One Biz Story:

The Story of Weave: SaaS For Dental Practices

In 2011 this guy was selling phone systems to dental practices and 9 years later had grown it into a BILLION dollar business.

But he didn't even get an invite to the company's IPO...

This the crazy story of Weave:

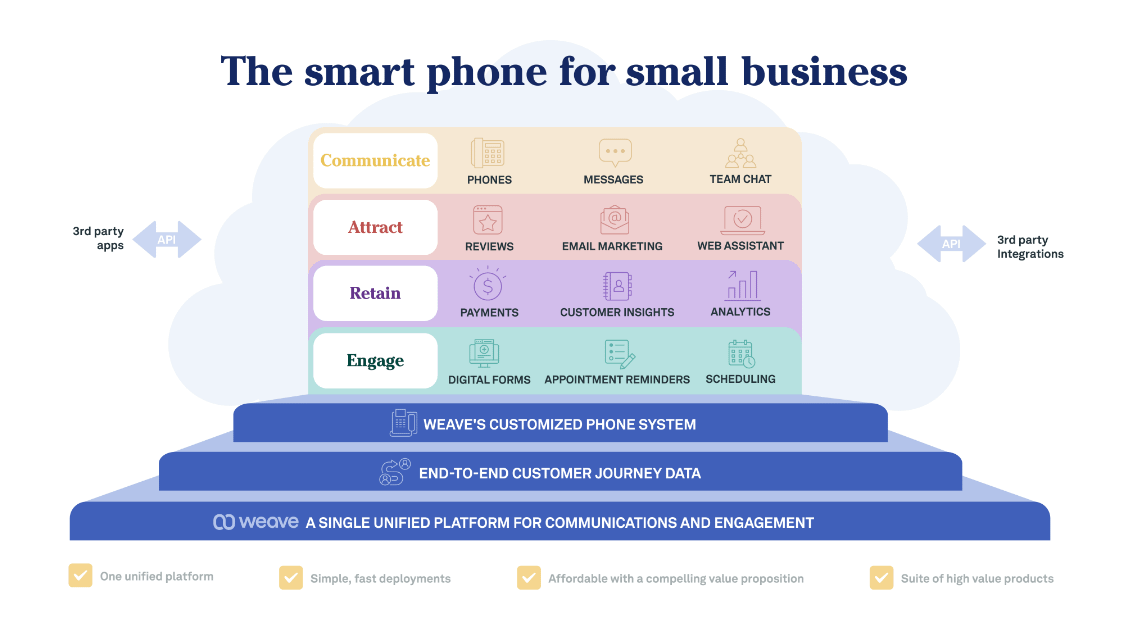

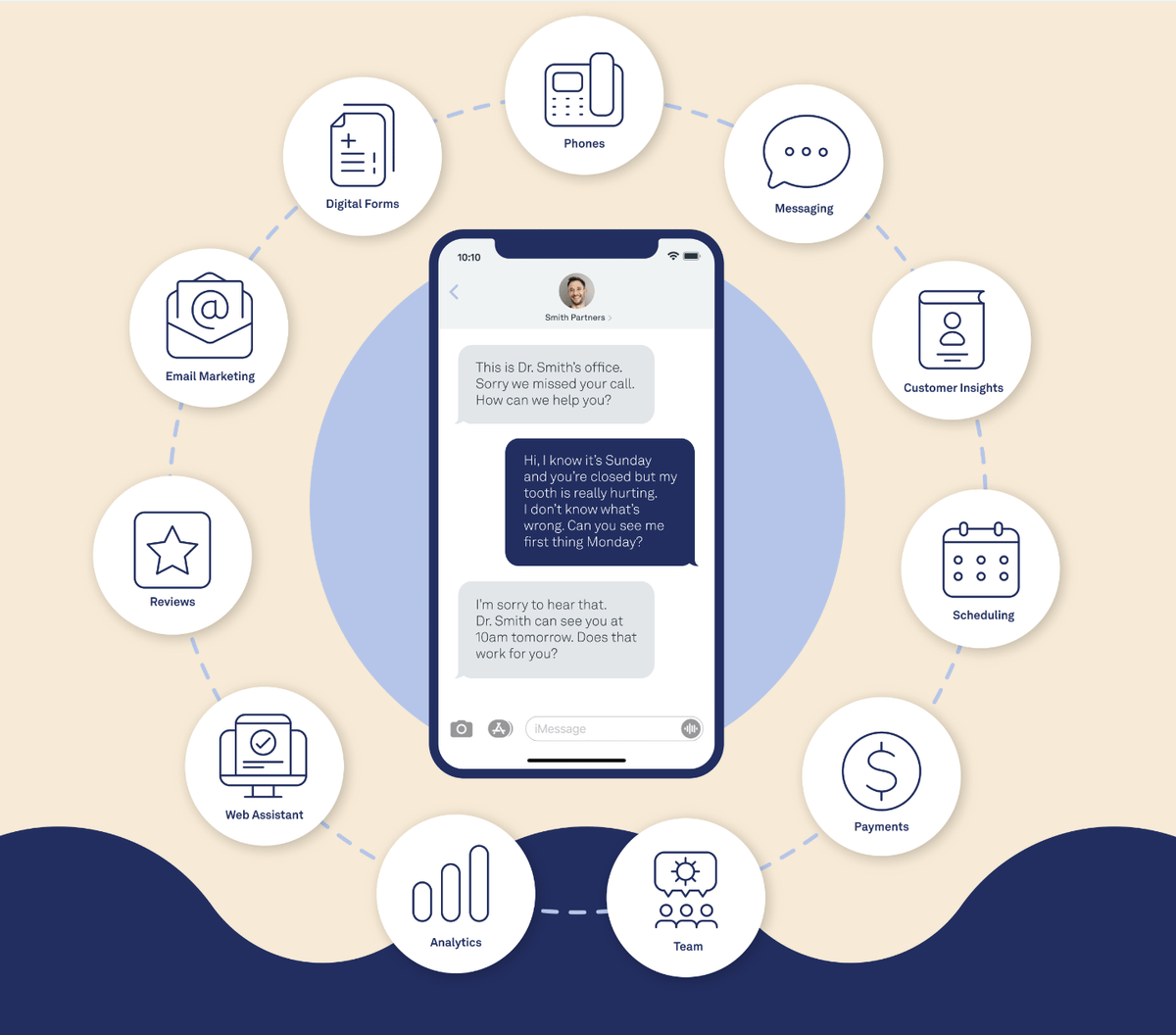

Weave is a leading CRM for small and medium-sized healthcare businesses. You can think of it like the "Salesforce" for Dentists. It build software that connects the entire customer journey from the first phone call to the final invoice and every touchpoint in between.

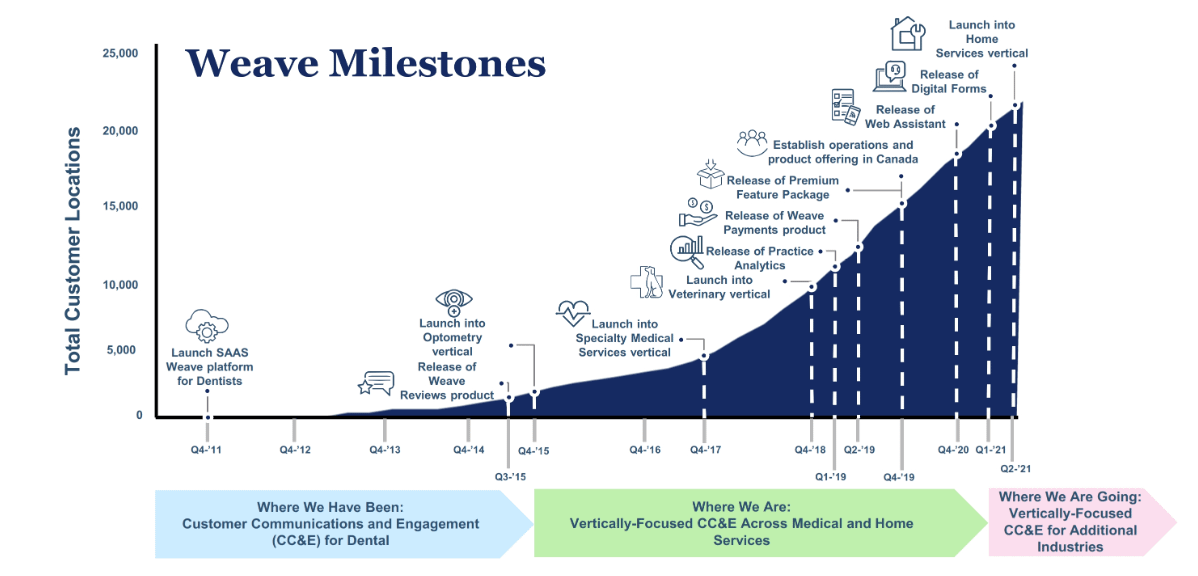

Founded in 2011 by Brandon Rodman, Clint Berry, and Jared Rodman, the group saw an opportunity to improve the communication between healthcare providers and their patients. They started with a simple idea: integrate phone and text messaging with existing back office software.

They convinced a Dentist in Utah, Dr. Jeff Gray, to come on board as their first customer. He who was looking for a better way to communicate with his patients. and signed up as a beta tester in 2011.

A year later, Weave was accepted into Y Combinator. And in July 2012, raised their first round, a pre-seed of $1 million in July 2012 from Pelion Venture Partners. Weave would go on to raise $168M in venture capital from Tiger Global, Bessemer, & many others.

While the trio initially launched with a pretty simple phone system that integrated with Dentist's Practice Management Software, they really scaled and evolved their product suite overtime, adding: Texting Email Reviews Scheduling & Appointment Setting Digital Forms & more!

Weave's most impressive accomplishment has been scaling their inside sales go-to-market. This is not easy to get right but they've done it. What started as three founders pitching dentists has turned into a 200+ person inside sales team that drives 400+ sign ups per month.

The result of this? Very impressive revenue growth. They recently reported total revenue of $115.9 million, representing a 45% year-over-year increase compared to $79.9 million in 2020. Weave also has strong retention, 103%. It is HARD to be over 100% in the SMB category.

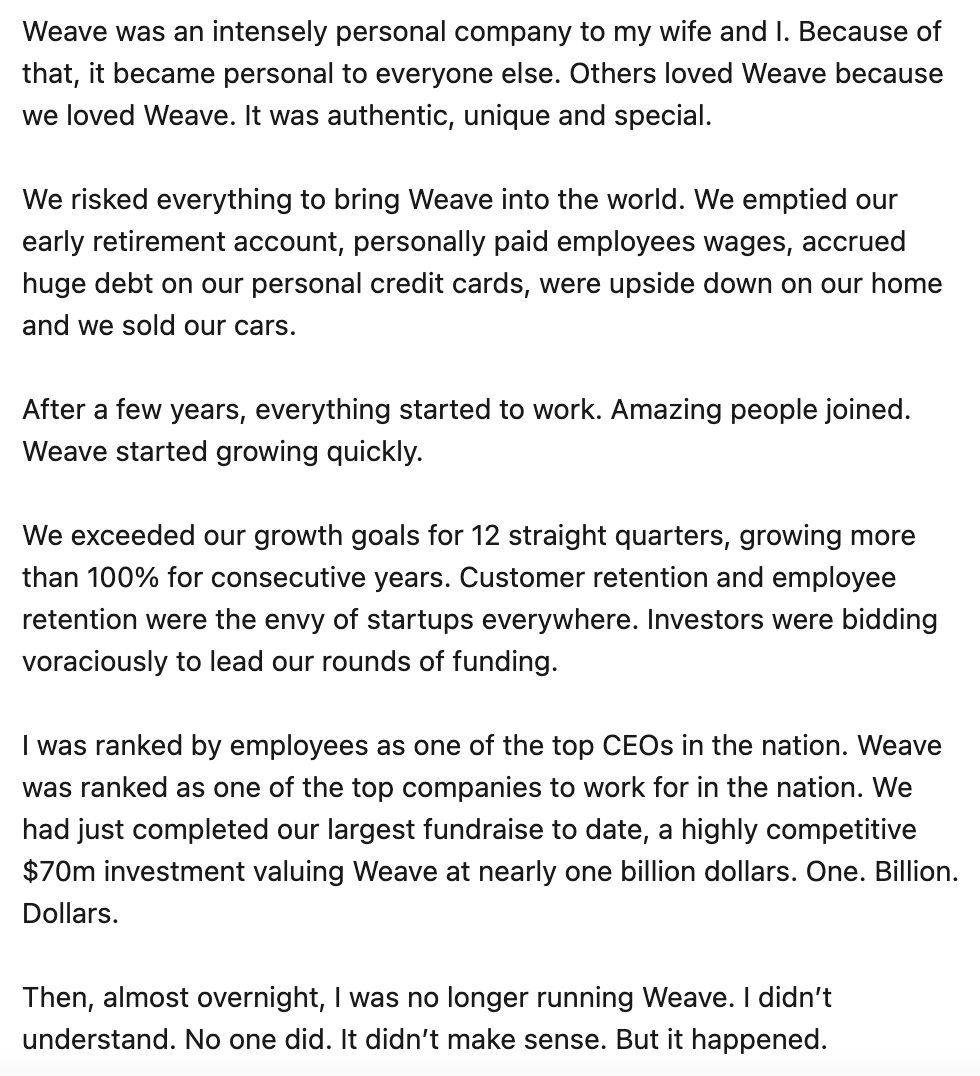

But this is where the story gets a bit dark. In 2019, Weave raised a big venture round that valued the company at $970M. Following that, the board told the Founder/CEO they thought it was time to find a new leader. And just like that, Brandon Rodman was out as CEO.

Weave went public on the New York Stock Exchange on November 11, 2021, under the ticker symbol WEAV. It raised about $110 million in fresh capital, valuing the company at about $1.8 billion. Sadly, the founders weren't invited to the IPO. Rodman had this to say about it:

Weave has continued on w/o the Founders and expanded beyond dentists. Their aim now is create the premier customer experience platform for small and medium-sized businesses across all verticals. They want to support businesses attract, communicate, and engage their customers.

It's a remarkable story of the ups and downs, and how venture-backed founders often lose control over time. But it's still incredibly inspirational. What started as a few guys selling software to dentists turned into a billion dollar software company.

The founders definetly have a chip on their shoulder, with the former Founder/CEO saying this:

I am excited to see what they will do next...

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: