#053: Picking The Right Market To Go After, Constellation Software Case Study, A Magical Phrase

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week. Written by @LukeSophinos

Happy New Year all! I hope 2024 is your best yet.

Let’s dive in…

One vSaaS Breakdown:

Picking The Right Market To Go After

The market you choose to go after is a huge determining factor in your success. I get asked often, “How do I ensure I’m going after the right market?” Here are the questions you need to answer…

Question #1. Is it big enough of an opportunity? This all comes down to how big of a business you’re trying to build. If you want to raise money, VC’s will require you to go after a market that can create a billion dollar business. Do a TAM (Total Addressable Market) analysis:

If I charge $ X, and everyone in the space buys my solution, can this create a business that is big enough if I achieve 5, 10, or 15% market share? Remember, most businesses start to plateau around 15-20%. So you need to have a lot of room to grow into it.

Question #2. Does the market have a healthy segmentation? You have to be comfortable with how the market is segmented. If it’s monopolized by 5 players ie. Telecom it’s going to be hard to win. I always look for markets that have a good mix of SMB, MM, and ENT companies.

Question #3. Can I compete and win in this market? Doing a competitive analysis is important before really going after your idea. If you’re entering a space that has hundreds of venture-backed competitors, that has already been ‘won’ it’s going to be difficult.

Look for blue-ocean markets, places that lack a bunch of offerings. It’s healthy to have competition, you just don’t want an absurd amount of it.

Question #4. Are the end customers willing to change? Some markets lack early adopters and individuals that are even willing to try anything new. Some just won’t change even when they know they should. Make sure you’re going after a space where folks want to grow and improve.

Autoshops & mechanics are a great example of a market that has historically just been unwilling to change. A few companies have really gone after this raising tens of millions or even hundreds of millions only to make a tiny dent.

Question #5. Can I sign up a significant number of customers with the first version of my product? If your end-market is full of massive companies, they aren’t going to change without a HUGE product that takes millions or tens of millions to develop.

Finding a space where you can get in the door with an initial light-weight offering is crucial. You don’t want to be in the lab building a product that doesn’t have users for years. Regardless of validation you won’t really know what to build until it’s in the customers hands.

I’m a big proponent of market scorecards. You can build a rubric with all of these questions baked in, and feel free to add some more. Create a list of hundreds of markets and force rank them based on your scorecard. It doesn't have to be fancy. Here's a basic example:

Choose the right market.

Do the work up front.

It will make life so much easier.

One Biz Story:

Constellation Software

Meet Mark Leonard, the founder, and CEO of Constellation Software. A company like no other. Since debuting at $70M at the Toronto Stock Exchange, the company has increased in value by ~ 70,000%. Constellation software is currently valued at ~$49B, it was founded in 1996. Mark Leonard drives the company forward.

Here is how it all come to be:

Mark started his career as an intern at Barclays. His mentor there told him he was going to make a terrible banker. So he studied the firm's clients and found a career path in venture capital.

After spending 11 years in Venture Capital, Mark realized something. "It was difficult to focus on a specific industry and the investment returns were erratic and underwhelming. " He wanted to build something permanent.

So, Mark came up with the idea of creating a permanent capital vehicle to acquire and hold vertical software businesses forever. FOREVER. With $25M from his old venture colleagues, Mark started Constellation Software in 1995.

The goal of the company was simple: Become the best buyer of Vertical Software businesses in the world.

Vertical software companies target specific markets like hospital management. Companies like these have high gross margins and sell software vital to their customers' operations.

It's sticky, it's lucrative, and it's mission-critical.

Constellation likes to acquire small VMS companies, usually for around $2-5M Some criteria for the types of businesses they're after:

Since 1995, Constellation has acquired 500+ vertical software companies across 75 industries - from education to yachting.

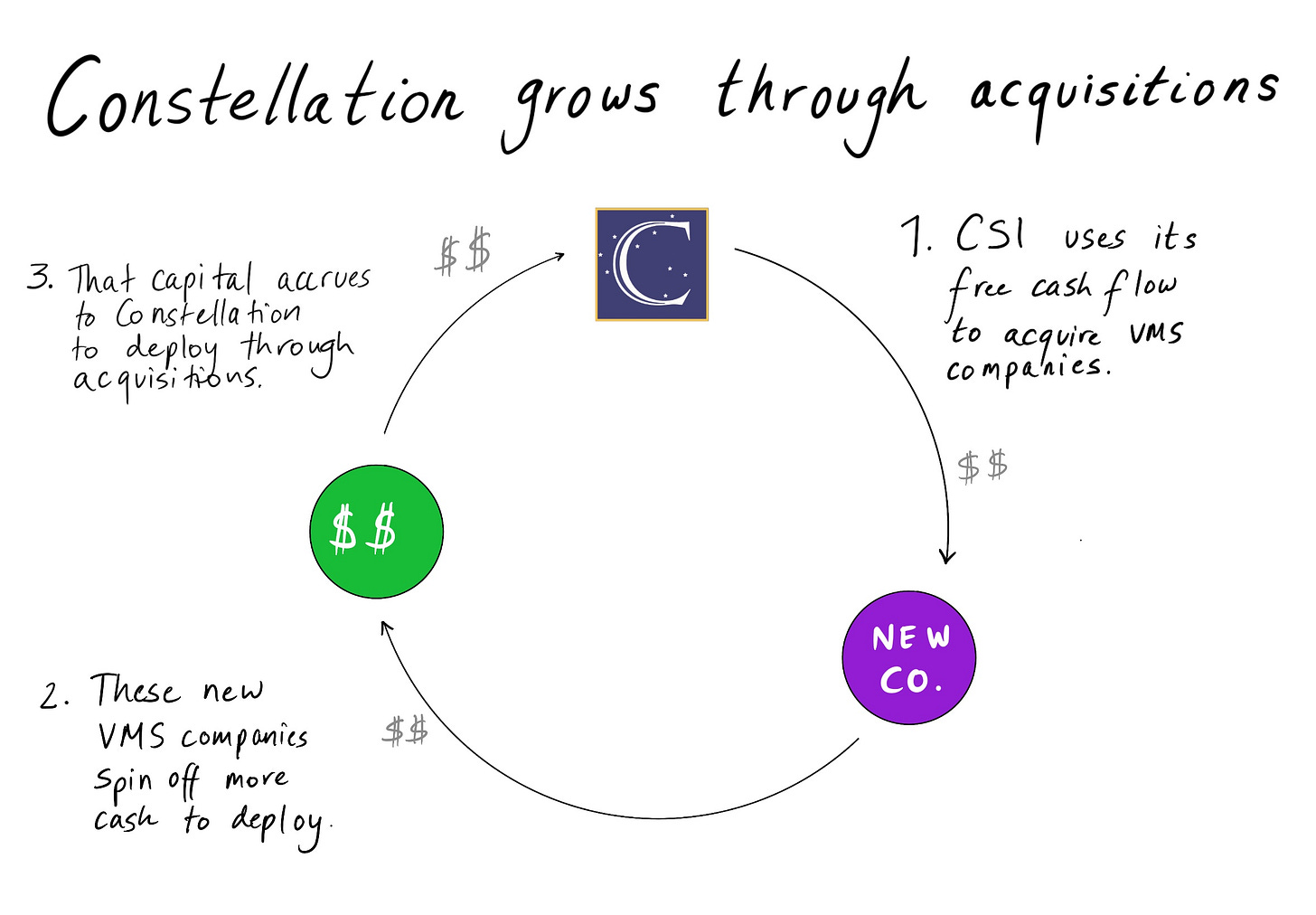

They rely on a simple cycle: The vertical SaaS companies they buy shoot off cash, which gives Constellation more cash to buy more companies.

This begs the question, How does Constellation manage 500+ companies? It splits them into 6 operating groups:

Each group has a director responsible for helping the companies in that group succeed. I love this part!

Three cultural tenets govern Constellation:

Autonomy

Constellation is all about decentralization - they want decisions to be made closer to the ground. Here's what Mark said in one of his shareholder letters:

Long term

CSI doesn't want to sell the companies it acquires for a profit. It wants to acquire them, then hold them forever. Since inception, they have only sold one business because they were offered a really high price in its early days. Mark regrets selling to this day.

Meritocracy

Mark wants his employees to stick around; so he takes great care of them.

Good pay

Stock bonuses

A clear path to move up

Get this, By 2015 more than 100 CSI employees were millionaires! And Mark wants to make 500 more in the next 10 years. The bulk of that cash came from the company's stock, which employees are required to buy - some can get up to 75% of their salary in $CSU shares!

Fun fact: Mark is not paid a salary or a bonus. His entire compensation comes entirely from building the value of his holdings over time.

So what's next for Constellation?

Today, they generate a free cash flow of ~$1B on $6.5B in revenues with free cash flow margins of 20%. The problem for Mark and Constellation now is that they have got more money than they know what to do with.

So they are:

Lowering the bar for new investments

Buying bigger companies

Expanding outside the vertical SaaS

For me, Mark and Constellation Software are the epitome of success.

They built a SOFTWARE EMPIRE through smart acquisitions and a killer cash flow cycle.

They take great care of their employees.

They keep growing.

I leveraged two great write-ups for this. Thanks to @mariogabriele for writing a great breakdown on Constellation: https://www.generalist.com/briefing/constellation Shoutout to @bizbreakdowns for their excellent episode on CSI.

One ‘How To’:

A Magic Phrase…

Try honestly to see things from others point of view.

"A magic phrase that will stop arguments, eliminate ill feeling, create good will, and make the other person listen: ‘I don’t blame you one iota for feeling as you do. If I were you I would feel the same way."

Try this out in the new year in tough interactions and conversations.

I’ve found it works beautifully in almost all cases.

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: