#050: The Story of 2U, McKinsey SaaS Multiples, vSaaS vs hSaaS Defining Characteristics

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

One Biz Story:

2U: Software & Services For Higher Education

This guys EdTech company is about to cross $1 BILLION in revenue.

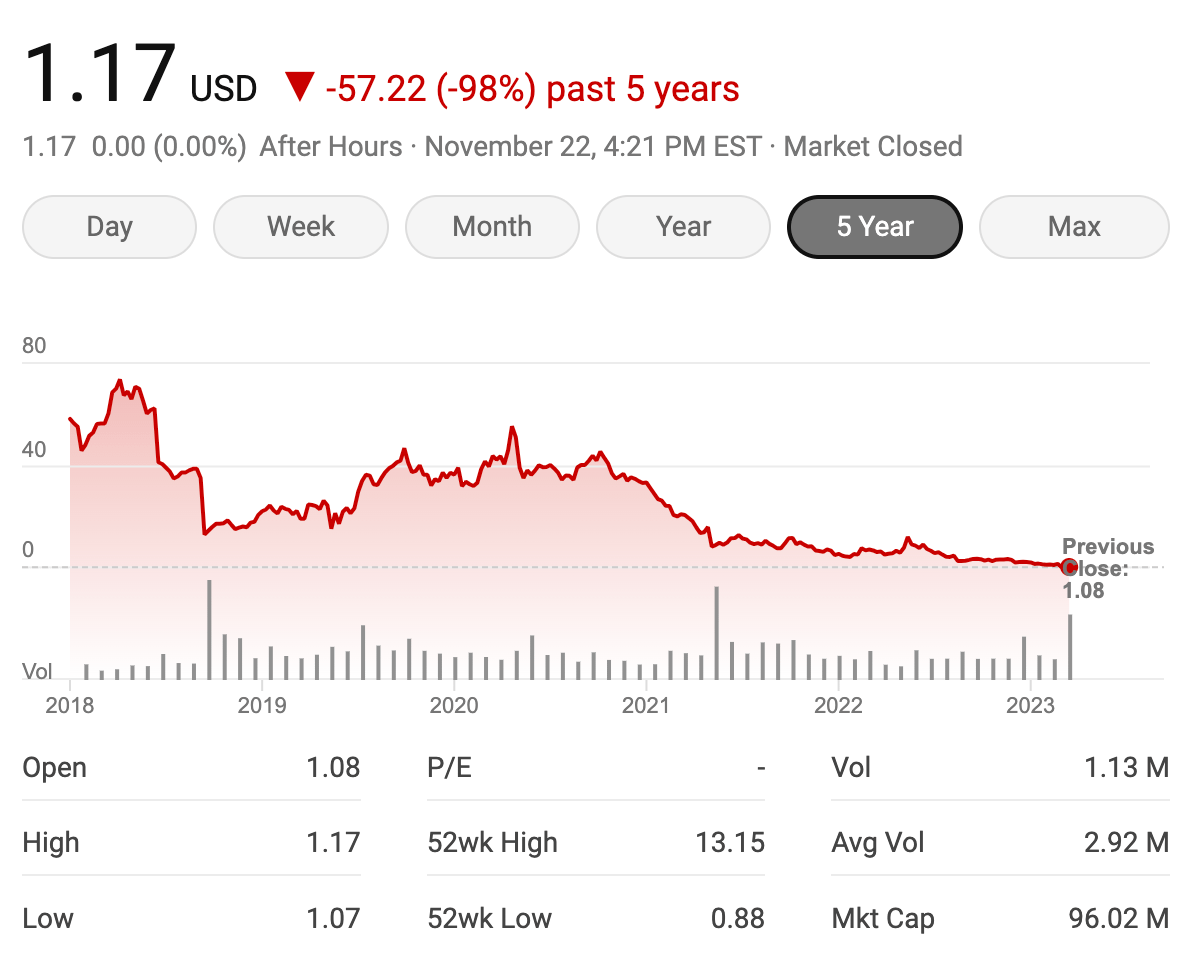

He cracked the notoriously difficult market of higher education but it's currently only valued at ~$100M.

This is the story of 2U:

2U is a tech company that partners with universities and organizations to provide online education programs. It was founded in 2008 by Chip Paucek, John Katzman, and Jeremy Johnson. Their goal was to deliver high-quality degree programs 100% online from top university brands.

So how have they done it?

2U’s go-to-market strategy is all about building strong relationships with prestigious universities. They deploy a outside field team and spend a pretty penny on marketing with conferences and events being a big partner acquisition driver.

Then, they help universities design, build, and deliver online degree and non-degree programs. They provide the technology, marketing, & student support, while universities provide the academic content and faculty. You likely don't even know you're in a course designed by 2U.

2U’s product suite includes four categories:

-Degree programs

-Short courses

-Boot Camps

-EdX, a MOOC platform (massive open online course)

Degree programs are online masters degrees offered by universities. Short courses are online certificates and credentials offered by universities or corporations. Boot camps are online and hybrid courses that teach in-demand skills like coding, data analytics, or cybersecurity. Recently, they've really shifted their focus to EdX.

2U’s revenue growth has been impressive over the years. In the first nine months of 2021, 2U reported revenue of $729 million, up 32% from the same period in 2020. And most recently, 2U is about to cross the big kahuna, $1 BILLION in Revenue.

The crazy thing about 2U is they only have about ~250 university customers. But those ~250 customers make up close to 50K students. That puts their average contract value at ~$4M per partner! Some of 2U's customers include Harvard, Georgetown, and Yale.

2U’s customer retention has also been strong. In 2020, 2U reported a net promoter score (NPS) of 62 for degree programs, 66 for short courses, and 71 for boot camps. It's clear students and colleges like what they're serving up.

2U has also made several acquisitions to expand its portfolio and reach:

GetSmarter - a company offering short courses.

Trilogy Education - a company offering boot camps.

edX - an online learning platform founded by Harvard and MIT

2U went public in 2014 at a market cap of ~$490M. Some of the big winners in the IPO were the company’s founders who collectively owned about 20% of the company. Other winners included the company’s early financial backers, Redpoint Ventures and Highland Capital Partners.

But they've also recently faced some criticisms...

They've been accused of charging high tuition and faced legal challenges and lawsuits with the Department of Education. It is pretty common for the Department of Ed to go after those that profit in and around education.

Today, 2U's market cap is <$100M even with their massive revenue run rate. Investors seem scared off by the regulatory uncertainty surrounding the business. The result? 2U is shifting focus to go all in on EdX, which is an online elearning platform similar to a Udemy.

And to make matters more challenging, in late November of 2023, Chip Paucek, a legend in the EdTech space and 2U Founder & CEO, announced he was transitioning out.The board is actively seeking out a new CEO.

2U's model to partner with leading orgs like Yale, Harvard, & IBM to offer online courses was ahead of its time. It's a pioneer in the online education industry.

They've definetly built something special, I'm hopeful they can work through some of these regulatory challenges.

Kudos to Chip and the team. You all have built an inspirational business in a very difficult market. It's been a joy to watch.

One vSaaS Breakdown:

Some vSaaS vs hSaaS Defining Characteristics

A few characteristics I always see in Vertical SaaS that usually just aren’t true in horizontal SaaS:

1. Market penetration can be as high as 50%

2. Going multi-product has to happen much earlier

3. Integration is typically very difficult or not standardized

4. Digital acquisition channels are far less effective, especially at scale

5. Retention rates are stronger as your not trying to build for such a vast audience

6. FinTech (payments, etc.) is almost always a key to building a sizable business.

What did I miss / what else would you add?

One ‘How To’:

McKinsey 2023 SaaS Analysis

<20% YoY Growth: 4.6X Revenue

20-30% YoY Growth: 5.8X Revenue

30-40% YoY Growth: 7.6X Revenue

40%< YoY Growth: 10.8X Revenue

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: