#049: Are We Back to 6X ARR? Software Companies Are Getting FIT, The Story of Disco: Law Firm vSaaS

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

One vSaaS Breakdown:

Are we back to the 6X ARR world?

If you're an investor or founder it's probably safe to just plan on that. Sounds like SaaStr and Jason Lemkin believe so...

One ‘How To’:

Software Companies Are Getting FIT

Since the SaaS crash of November 2021, followed by the SVB bank debacle it has been a TOUGH few years for SaaS companies. To be fair, things did get a little out of hand there for a while.

But software companies are getting fit - focusing on efficency over growth for the first time in more than a decade.

Publicly traded SaaS companies have had a maniacal focus on the Revenue Per Employee metric as a key input to driving profitability.

Here’s the public comps from Theory Ventures:

For some additional color, If you have $10M in ARR and 100 employees your looking at $100K of revenue per employee. Not good in today’s market.

The days of bragging about employee count are long gone.

What folks want to see is how can you achieve more with less. <40 employees at $10M, <100 employees at $20M, <5 at $2M. That’s the real victory.

One Biz Story:

DISCO: All-In-One Legal Tech Software

This guy was the youngest ever Harvard Law School graduate at 19.

He then founded and took public a software platform for law firms, that was valued north of $2 BILLION.

This is the story of DISCO, the all-in-one SaaS for law firms:

DISCO is a legal tech company that applies AI, cloud computing, and data analytics to legal problems. They help law firms improve legal outcomes for their clients. Let’s go deeper into their founding story, product suite, go-to-market, revenue, retention, and vision:

DISCO was founded in 2013 by practicing litigators who wanted to create a better way to automate the parts of the law that do not require human legal judgment. They saw an opportunity to change the legacy ediscovery market with a faster, smarter, and more user-friendly solution.

The founders of DISCO are Kiwi Camara, Gabe Krambs, and Kent Radford. Camara is the CEO and a Harvard Law School graduate who started his own law firm at 21. Krambs is the CTO who previously worked at IBM and Microsoft. Radford is the COO and a former partner at Jones Day.

DISCO’s go-to-market strategy is to target corporate legal departments, law firms, government agencies, and legal services providers across the world. They sell their products through a direct sales force, channel partners, and online self-service.

DISCO’s product suite covers all parts of the litigation lifecycle, including:

1. E-Discovery

2. Case Management

3. Document Review

4. Workflow Management

5. Data Analytics

6. AI-Chatbot

DISCO has been growing rapidly since its inception. In 2022, they generated $135 million in revenue, up 19% from 2021. They have incredible retention numbers, their s-1 stated gross logo retention of 95%, and a net revenue retention rate of 121%.

DISCO has also made several acquisitions to expand its product offering and customer reach:

Levity, a provider of AI solutions for contract analysis.

Nextpoint, a provider of cloud-based ediscovery software

Esquify, an AI-powered workforce management tool

And others...

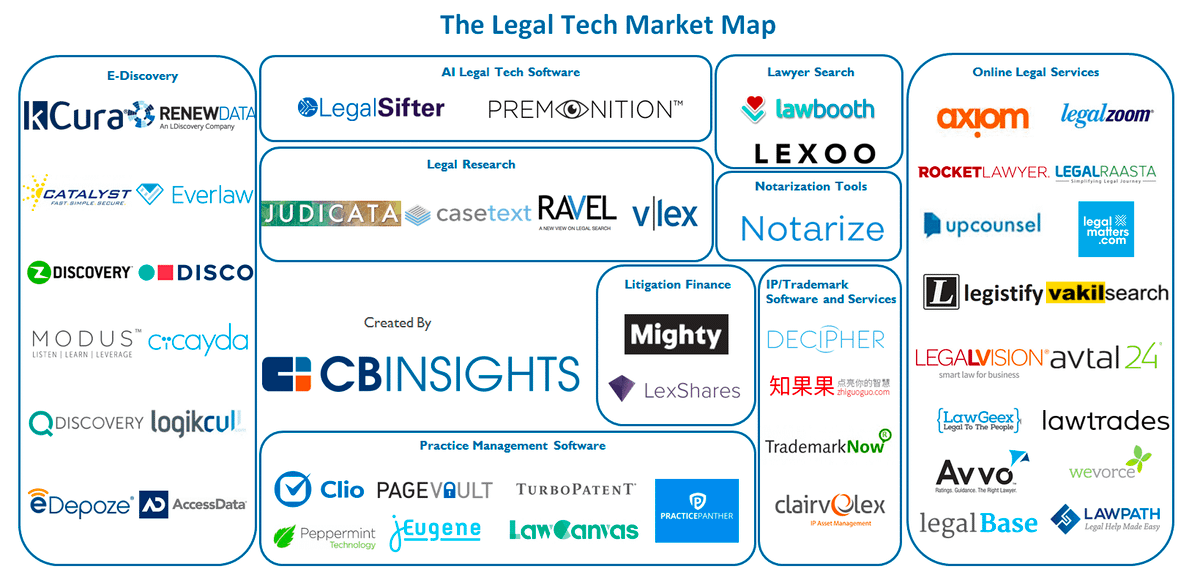

Competition is VERY steep in the legal tech world. Lot's of established players, and a ton of new upstarts with the rise of generative AI.But this hasn't held back their growth...

DISCO went public in July 2021, raising $224 million in its IPO. The company is traded on the NYSE under the ticker symbol LAW. As of November 2021, the company has a market cap of $2.3 billion, and a share price of $34.

But more recently, DISCO has fallen victim to a tough SAAS market and steep revenue multiple contractions. Their market cap has plummeted from $2B+ to ~$375M. Even with $135M in ARR, they are only trading at roughly 3X.

Last month, the founder/CEO Kiwi Camara stepped down from the company after 10+ years at the helm.The details around why are very negative, with the NY Post making some serious & concerning allegations against him. Board member Scott Hill stepped in as interim CEO.

It is clear that Disco has built one of the market leading vertical SaaS platforms for the law space. Growing ~20% YoY with strong retention, I'm surprised to see it only valued at ~3X ARR.

What do you think the future holds for this company?

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: