#046: The Story Of Procore, McKinsey Industry Digitization Index, Vertical SaaS DOES NOT Have To Be The ERP

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

One Biz Story:

The Story of Procore (Construction Management Software)

It's not very often that you see a company take ~10 years to get to ~$4M in revenue, and then absolutely explode to $250M+. A vision ahead of its time, that ultimately caught up to the rest of the world. This is the story of Procore:

The idea behind Procore came from the personal experience of its founder and CEO, Tooey Courtemanche (@TooeyProcore). In 2002, he was trying to build a new home for his family in Santa Barbara, but faced many challenges managing the project from his then-home in Silicon Valley.

He realized he needed a better way to communicate and coordinate with the owners, general contractors, and specialty contractors. He also saw an opportunity to digitize and modernize the construction industry, which was lagging behind other sectors in terms of technology.

He decided to create a software solution that would streamline workflows, provide real-time visibility, offer advanced analytics, and support collaboration across the construction project lifecycle. He named it Procore, and launched it in 2003 as a cloud-based platform.

Procore was initially headquartered in Montecito, California, and had a small team of engineers and salespeople. The company faced many challenges in convincing customers to adopt its software, as many were used to paper-based or legacy systems.

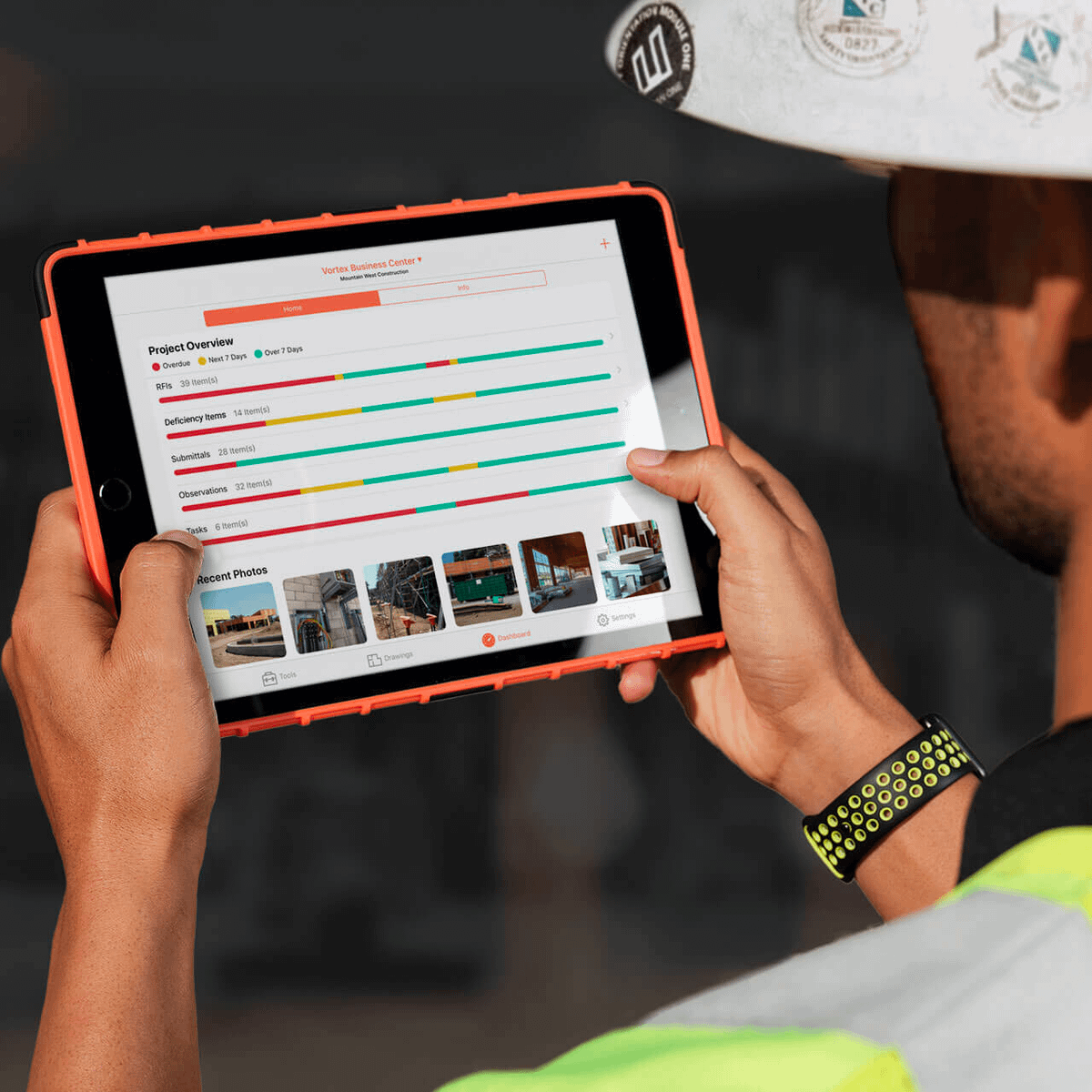

However, Procore’s product proved to be easy to use, install, and adopt by end users, typically individual contributors in the construction industry. Procore also offered unlimited users and unlimited support, which differentiated it from its competitors.

Procore’s revenue grew very slowly over the years, it took ~10 years for them to reach $4.8 million in 2012. But the birth of the mobile era would change everything for Procore... When mobile internet connectivity came to job sites the industry caught up with Tooey's vision.

The company implemented an inside sales engine and doubled it's ARR growth rate. The company then began to attract the attention of venture, and Bessemer Venture Partners and Iconiq Capital, led several funding rounds. The company raised close to $500M over the next ~8 years.

Procore also expanded its product portfolio by adding new features and integrations with over 180 third-party applications. The company also acquired several companies that enhanced its capabilities, such as Honest Buildings, Esticom, Avata Intelligence, and INDUS.

Procore filed to go public in 2019, but delayed its IPO due to the coronavirus pandemic. The company finally went public in May 2021, raising $634.5 million and reaching a market cap of over $11 billion. The company’s stock trades under the ticker PCOR on NYSE.

Today, Procore has over 10,000 customers, over 1.6 million users, and over 2,000 employees across more than 125 countries. The company’s revenue in Q3 FY2023 was $247.9 million, up 33% year over year. The company also achieved positive cash flow of $18.7 million in Q3 2023.

Procore’s mission is to improve the lives of everyone in construction by connecting them on a global platform. But it's also story of perseverance, and an unwavering commitment by an entrepreneur to his vision for the world. There is no such thing as an overnight success!

One vSaaS Breakdown:

Vertical SaaS Do NOT Have To Be The System of Record

vSaaS doesn't have to be the system of record.

That's a myth in my opinion. My friend @shawnchance over at @OMERSVentures just dropped a great read on The Evolution of vSaaS (below):

Although this model is fairly self-explanatory, a few nuances to call out:

Companies/products rarely fit squarely into any one category -although most will have a strong bias towards one (as illustrated by a few sample logos)

The momentum of VSaaS today is towards the right (in other words, a company that may have started out as a "system of record" is likely to build features or products that take them into "systems of intelligence" or "systems of action")

As such, legacy VSaaS companies tend to be more on the left and newer entrants in the middle and on the right

As companies move the the right, they tend to embrace the data moats that VSaaS companies are uniquely positioned to build quickly, thereby unlocking "intelligence" and "action" which can also be catalysts for new revenue streams or pricing tiers

There are many ways to win: where a company sits on this chart isn't inherently "better" and we are seeing winners in every category.

This is version 1.0 and, like any good product, will be a permanent work in progress. I’d love to hear how others are looking at VSaaS and how the value these products deliver continues to evolve – from features to revenue models to the integration of AI/ML and fintech products.

What are your thoughts? Agree/disagree?

One ‘How To’:

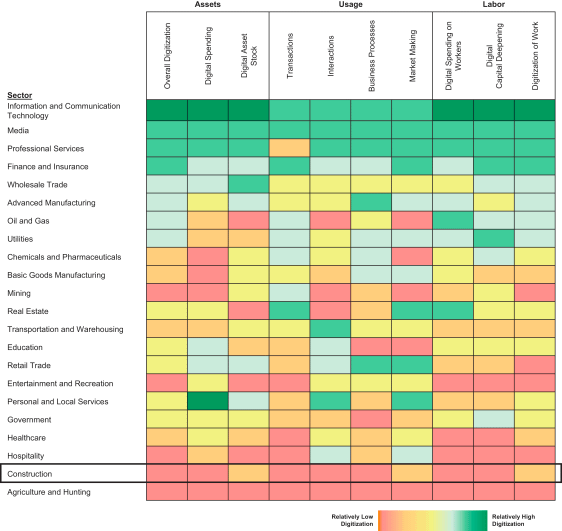

McKinsey Industry Digitization Index

A bit old but a great overview of which industries still need vertical software.

Have a product or service that could benefit our community of thousands of vertical SaaS founders, investors, and operators?

I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers.

If that’s you, click the link below: