#038: Public vSaaS Market Penetration, The Appfolio Story, How Much ARR Can A CSM Manage?

One vSaaS breakdown. One biz story. One 'how to'. In your inbox once a week.

One Vertical SaaS Breakdown:

Publicly Traded Market Share of vSaaS Companies

One Biz Story:

AppFolio

It's 2016.

These two meet for lunch.

They pitch each other on an idea.

That idea would ultimately become a $6B software empire.

It's quite the story 👇

Meet AppFolio -- a cloud-based software provider for the real estate industry. It was founded in 2006 by Klaus Schauser and Jon Walker. The two had previously worked together at Expertcity, the company behind GoToMeeting.

Klaus and Jon wanted to create software solutions that would help property managers and real estate investors streamline their workflows and grow their businesses. They came up with the idea of AppFolio during a lunch meeting.

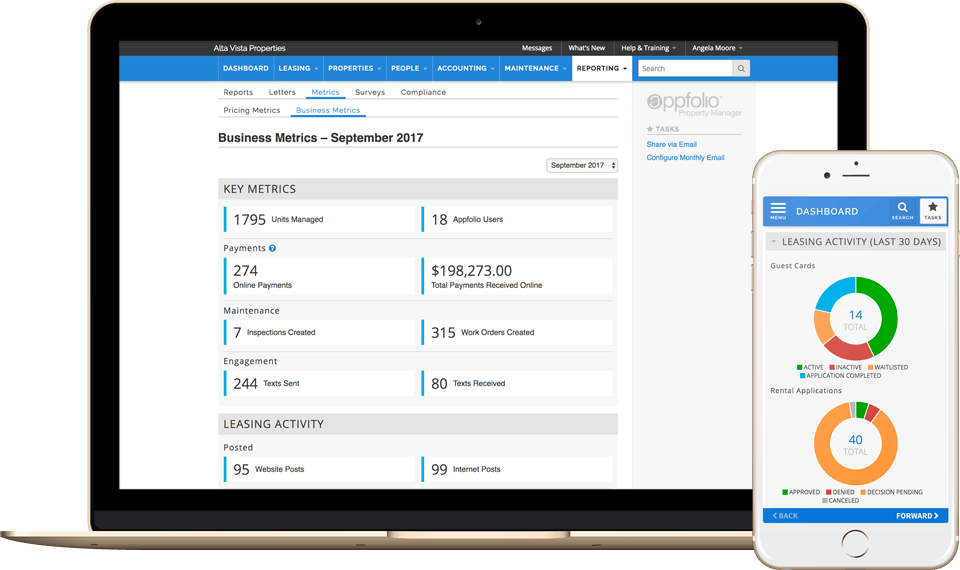

From that lunch meeting, they got to work, launching their first product, AppFolio Property Manager in 2007. It is a software tool that allows users to manage their properties, tenants, leases, accounting, maintenance, marketing, and more.

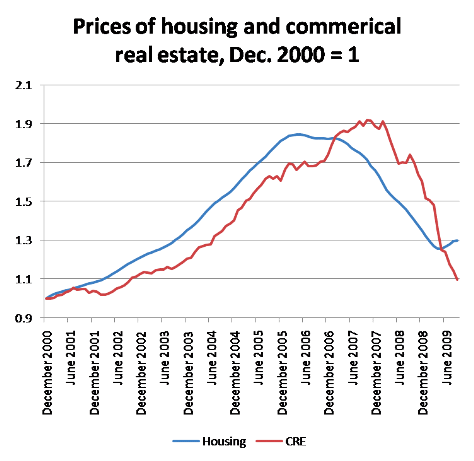

That was enough to get their Series A done, $5M in 2007 from BV Capital and Cisco. From there, they raised a $22M Series B in mid 2008, led by eventures I can only imagine how hard that Series B was to pull off in the middle of the real estate crash....

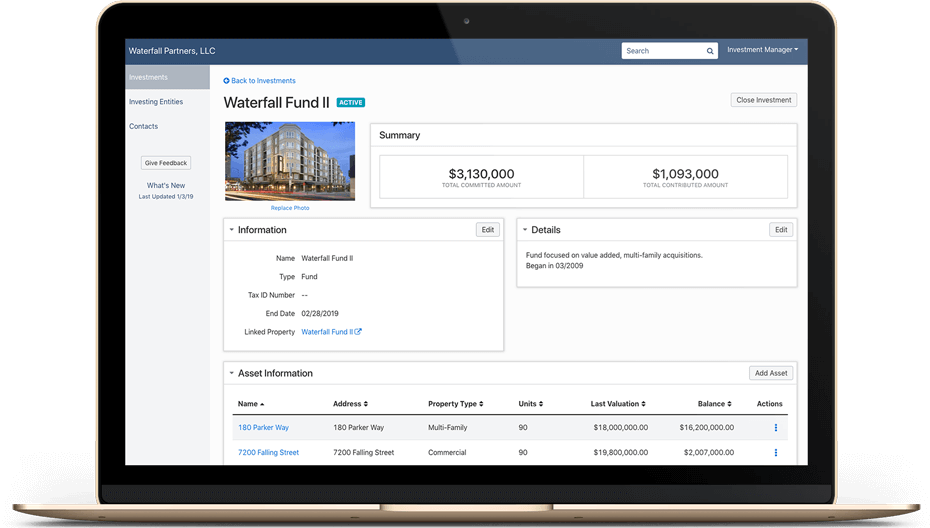

With the cash, AppFolio expanded its product portfolio to include AppFolio Investment Manager, a platform for real estate investment management. It helps users raise capital, communicate with investors, distribute returns, and generate reports.

With a maniacal focus on becoming an end-to-end solution, AppFolio went on an M&A tear, acquiring several other companies: RentLinx - rental listing syndication Wegowise - utility usage and energy efficiency tracking Dynasty - Vendor management for property managers

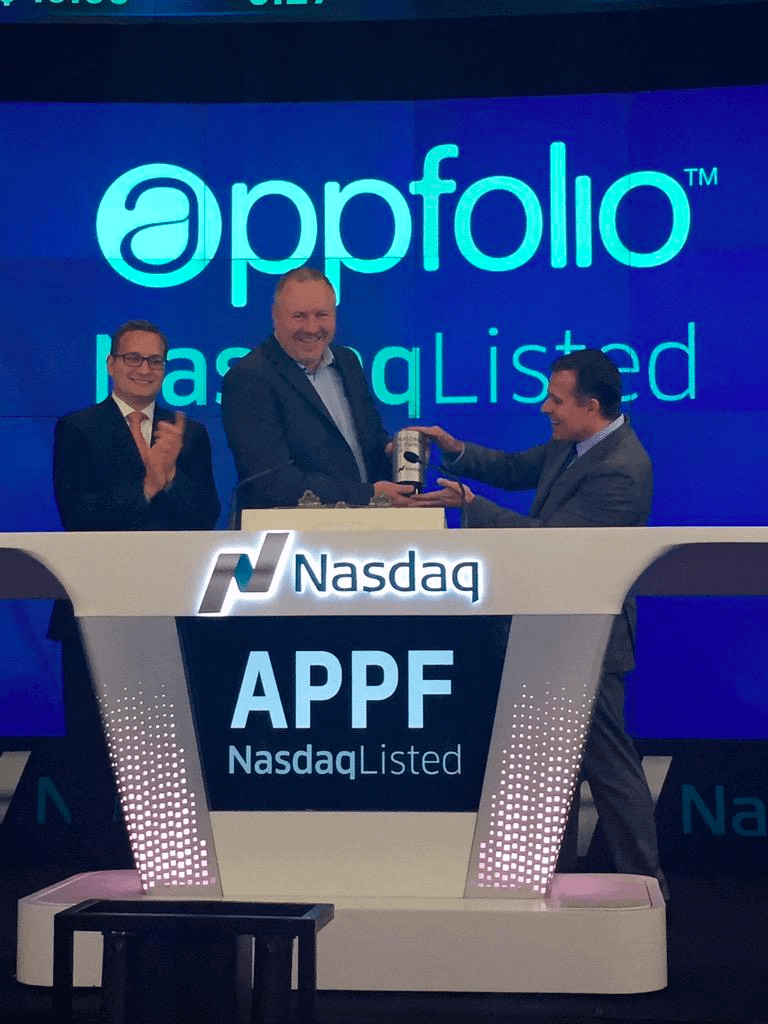

AppFolio went public in 2015 at ~$50M in ARR growing 80% YoY. They listed on NASDAQ under the ticker symbol APPF.

8 Years to $50M in ARR on ~$30M raised.

Impressive (!)

Fast forward to today, AppFolios revenue is around ~$147M. They have 19,145 customers, growing at ~25% YoY. And they've dominated their vertical, achieving roughly 15% market penetration.

Appfolio is a case study in vertical SaaS success. Extending across the entire value chain, and doing so in a very capital efficient way. Here's to Klaus, Jon, and the entire team. It's been a fun one to watch!

One ‘How To’:

How much ARR can a CSM Manage? (Thomasz Tunguz)

How much can a customer success manager manage? I’d heard the wisdom of $1-2M in ARR per year and around 80 accounts. But I hadn’t come across any data. Last summer, Gainsight posted the results of their survey on the topic. The truth is most CSMs manage between $2-5M in ARR and somewhere between 10-500 accounts. But it varies by segment.

The charts above display Gainsight’s data. I’ve reformatted them to compare segments side-by-side. In the Enterprise and MidMarket, the survey indicates most CSMs manage $2-5M in ARR. We see a normal distribution with a slight left skew. This means it’s rarer to see a CSM manage 10-20M in ARR than $0.5M-$1M in ARR in both cases.

In the enterprise, CSMs may be dedicated to a handful of large accounts boosting ARR per CSM. In the mid-market, where each account is worth in the mid-tens-of-thousands, 75% fewer CSMs manage $5-10M in ARR than in the enterprise. There is an upper limit to the number of relationships a CSM can manage. We’ll look at that data in a second.

In the SMB the distribution is more uniform. Price points in the SMB can vary widely, as can the success effort. In some cases, much of the CSM work might be automated because the work is lighter touch enabling greater efficiency per CSM and consequently higher managed ARR.

If we look at counts of accounts managed, the data is as you would expect. The lower the price point, the greater the number of accounts managed to reach that $2-5M in ARR managed per CSM.

If we take the midpoint of the most popular ranges in the enterprise to estimate enterprise ACV, we get $3.5M in ARR/25 accounts for $140k ACV.

The mid-market has a bimodal distribution: a spike at 50-100 accounts and another spike at 250-500 accounts. Doing the same midpoint math, the data suggests there are two types of MM companies: those in the 10k range and others in the 50k range. They are roughly equal in sample size for this survey.

The ARR per CSM figures in this survey were higher than I had expected. This is a pleasant surprise for startups because it means the CSM investment per dollar of ARR goes further.

The next analysis I’d like to see is the correlation of ARR/CSM to logo retention and customer expansion to answer the question: does a lower ratio of ARR/CSM translate into better expansion and retention?

Interested in advertising to thousands of vertical SaaS founders, investors, and operators? I’ve gotten a lot of inquiries lately and looking for the right partner from a company that can bring value to our readers. Reply to this email if you think thats you!